The Concept

Background

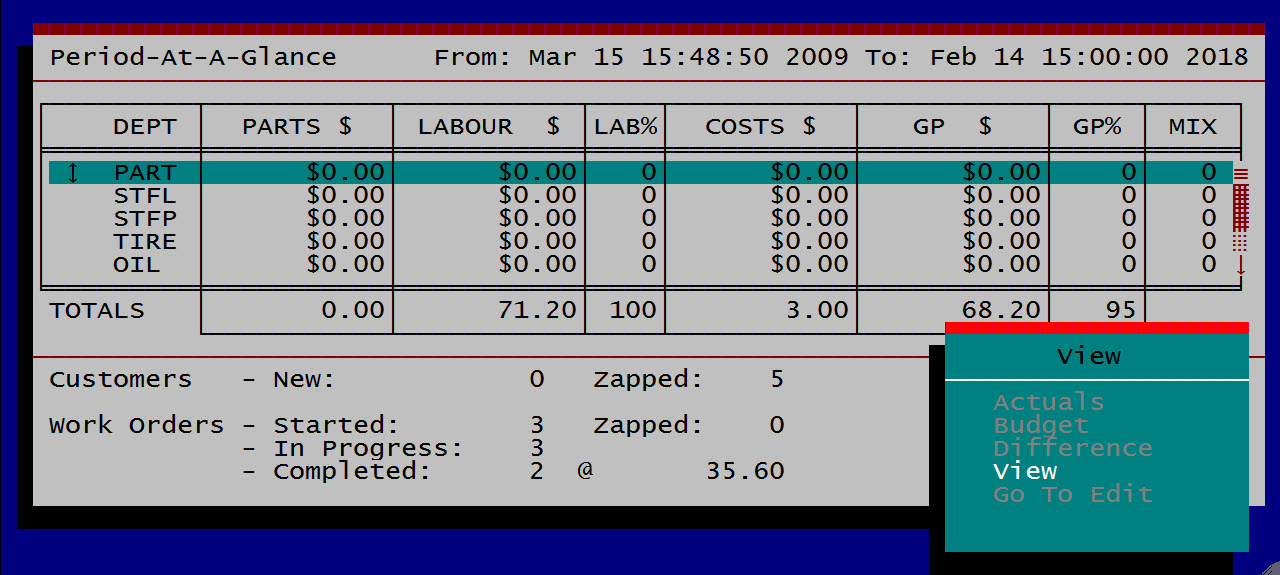

The concept of the PACE system is to provide the business owner with real-time financial information. With PACE the owner has the means to analyse sales data by: year, month, week, day or individual invoices. In addition, all expenses, assets (and amortization), prepaid expense amounts, accrued liabilities, long-term and short-term liabilities can be tracked on a monthly basis to provide a true monthly income and expense statement as well as a balance sheet.

The model for developing the program was based on a shop owner working the front counter. This is evidenced by the ease of creating and updating work orders, and the revenue information available from the work order screen’s menu. This is the nicest part of the program so obviously a lot of research and development was done to make it just right.

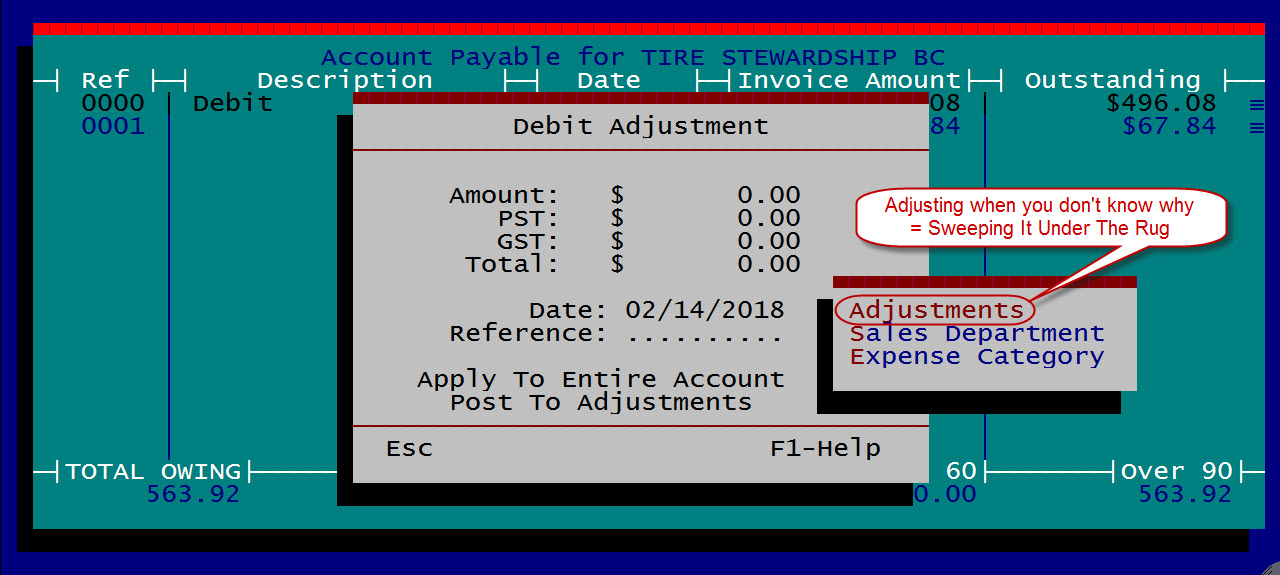

Presuming most shop owners are not familiar with bookkeeping, a feature was added that allowed the user to ‘force’ an account to reconcile by supplying various “Credit Adjustment” and “Debit Adjustment” accounts. Professional accountants call this “plugging” and is akin to sweeping dirt under the carpet. This works great for the busy owner on the front counter trying to get through the day, but it is a source of frustration for the accountant who has to deal with it later.

The Problems

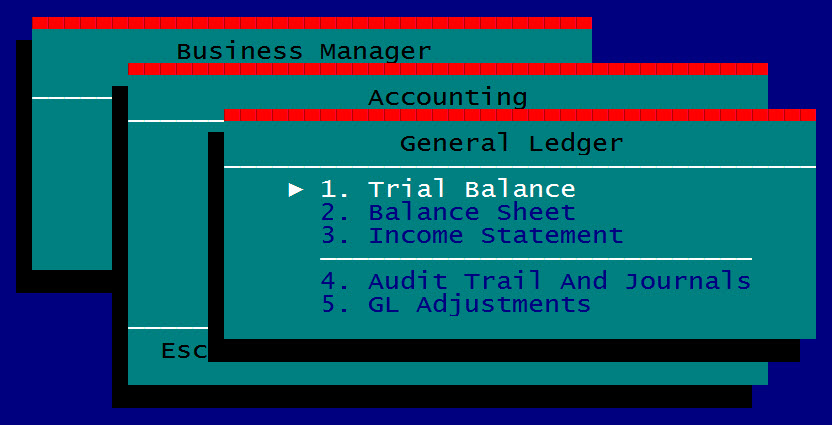

The single biggest problem the program has encountered is the reluctance of professional accountants and bookkeepers to accept it. This reluctance is due to three aspects:

1. The use of “Debit” and “Credit” terminology. From a layman’s point of view, a “credit” is something that is good. For example, on a bank statement the bank “credits” your account when you deposit money, therefore to “credit” a payables account must mean you owe a supplier less money. This is the opposite in the accounting world and it alienates those that ‘know’ accounting.

2. The PACE chart of accounts is specific to the automotive industry. Accountants do not necessarily understand their client’s industry, they rely on standard accounts to be able to determine what the figures represent, and the PACE chart of accounts is anything but standard. For example, I had one accountant that thought “cores” was a part of a car and made an inappropriate (and significant) adjustment to the year end statements.

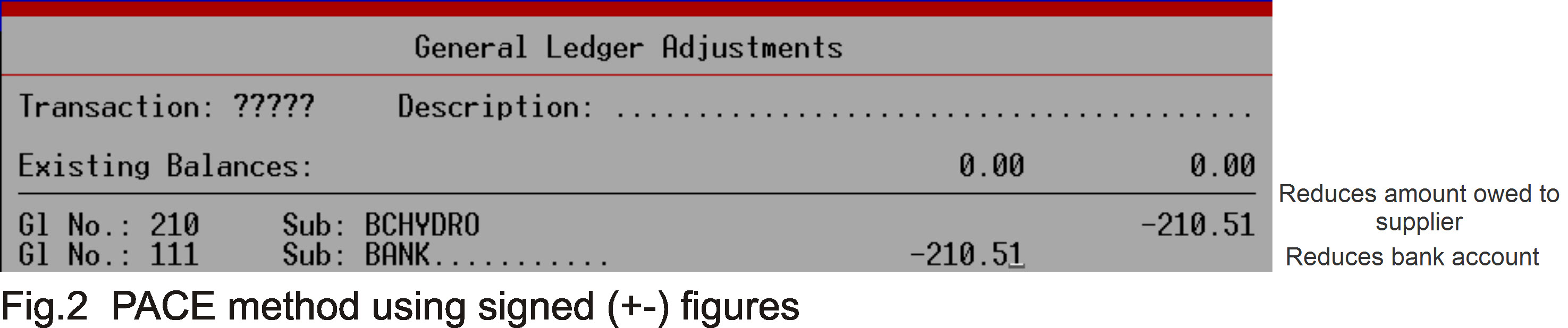

3. Displaying account transactions and balances using signed (+ -) figures instead of placing them in the appropriate Debit / Credit column. Again, to make the figures easier to understand for the layman, positive means the account has a higher balance, negative means less. This approach works well for the layman but, again, alienates those that learned the traditional method of accounting.

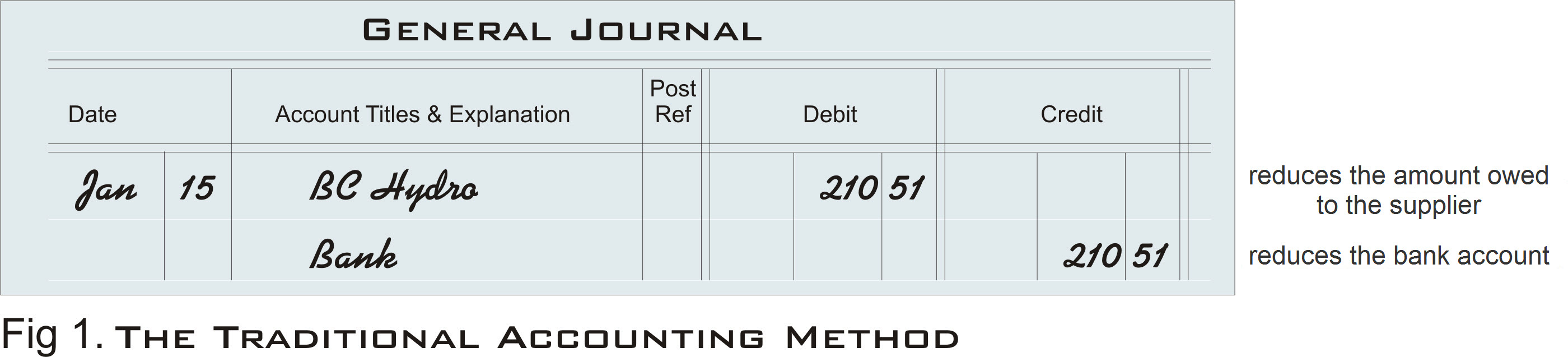

Here is an example of traditional accounting versus the signed method as used by PACE

The Traditional accounting method

A liability such as a supplier debt normally has a credit balance (ie the figure is under the “Credit” column). So if the figure appears on the left side it has the effect of reducing the liability. The Bank account has a normal Debit (left side) balance so putting an amount on the right side reduces the account.

The PACE method

The signed figures approach does not require switching sides, you only enter a positive or negative figure. In this example of the supplier account (a liability) the figure always stays on the right side; a positive number increases the amount owed, negative reduces the amount owed.

The practice of using signed figures in software programs has grown in popularity and is now commonly tolerated by professionals. PACE was just ahead of its time.

Achilles Heel

If there was one thing that PACE (the company) did poorly, it was the training model. The typical new sale consisted of delivery and setup of the equipment and a couple days of training (seminar style). After that there was phone support (which answered questions but could not elaborate on accounting) and then there was additional (paid) on-site support.

Based on my extensive experience providing on-site training and support, this training model was singularly responsible for the poor acceptance of the PACE accounting system. It also was the cause of the myriad of adaptations and work-arounds people created to try and make sense of how to use the program properly.

I have seen shops adopt the practice of printing out their account journals and audit trails as part of their month-end routine resulting in a couple thousand pages every month. I have seen shops dutifully printing pages and pages of reports because they were under the impression that the accountant needed all this paper. The sad fact is the accountant doesn’t need any of that stuff.

The year-end process is actually no different than the monthly process with the exception of one additional step that takes a few seconds. If you are running PACE properly, you can give the accountant everything they need in two 1 1/2″ binders at year end.